Growing Central Florida

Development Services

From initial inquiries about service availability to finalized plans, OUC can support your development project.

Economic Development

Our incentives and network of strategic partners can help you find a home in the greater Orlando metro area, one of the most exciting business climates in the country.

Sustainable Business Solutions

OUC is committed to powering sustainable growth in Central Florida by supporting businesses with a variety of innovative programs.

SunChoice for Businesses

Offset up to 100% of your company’s energy consumption with locally produced renewable solar energy through OUC’s Green-e® Energy certified SunChoice program.

Electric Vehicle Programs

Install an EV charging station or convert your fleet to electric—OUC experts are ready to help. Buy or rent EV chargers or contact us to electrify your fleet.

Multifamily Efficiency Program

Multifamily property owners can improve energy and water efficiency—and tenant comfort—with an OUC assessment and rebate programs.

Enhanced Utility Solutions for Your Business

OUC offers expert assistance and specialized programs to help your business thrive.

OUC District Cooling

Commercial property owners can outsource the production of chilled water for their air-conditioning needs, reducing A/C-related electric charges, as well as capital and operational costs.

OUC Lighting Programs

Complete lighting services for a wide variety of commercial applications, whether it’s a new development or a retrofit.

Protect and Monitor Your Equipment

Depending on your type of electric service and application, OUC can help you take additional steps to ensure that your equipment is properly protected.

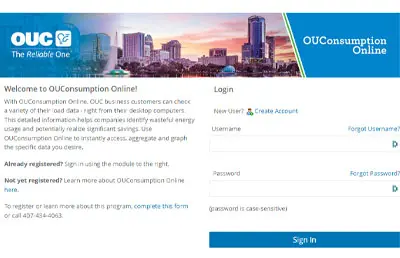

OUConsumption Online

Manage your energy consumption to make smart business decisions for one or multiple locations, view/compare usage among similar facilities and measure the effectiveness of your energy efficiency efforts.

Power Quality Analysis

Experienced OUC personnel analyze potential power quality problems and identify solutions to protect your sensitive electronic equipment.

Single and Three-Phase Service

Typical protection may not be sufficient to protect your three-phase equipment. The added safeguards provided by this program can be a worthwhile investment.

Business Energy Advisor (BEA)

About The BEA

A library of actionable information on managing energy and water costs specific to your industry or the technology you use.

Industries We Serve

Find your industry to learn more about energy conservation information specific to your business.

Technologies

Building structure and automation, cooking and refrigeration, ventilation and air handling, heating and cooling, pumps and motors, and many more.

Taxes for Business Customers

Taxes are levied on certain services by the State of Florida, the city, and the county based on the location where the service is provided. These taxes are collected by OUC on behalf of each taxing agency and remitted to each agency.

TYPES OF TAXES

Municipal Public Service Tax

This tax is imposed and administered by municipalities and charter counties and is governed by Chapter 166 of the Florida Statutes. Electric, water, fuel oil/kerosene, LP gas, manufactured gas, and natural gas utility services are subject to Municipal Public Service Tax. The cities of Edgewood, Orlando, St. Cloud, and Winter Park, and; Orange and Osceola counties levy this tax on OUC’s customers.

Florida Sales Tax

Each sale in Florida is taxable unless the transaction is exempt. Sales tax of 6.95% is levied on the sale of Electricity by the State of Florida.

Discretionary Sales Surtax

This tax is collected when services are subject to state sales and use tax. Both Discretionary Sales Surtax and Florida sales tax are collected and remitted to the Florida Department of Revenue. The Department distributes the discretionary sales surtax to the counties where the surtax is levied. The counties use the funds to pay for locally authorized projects.

TAX EXEMPTIONS

Depending on the type of business, some OUC customers may qualify for exemption from certain taxes on their bill. Exemption from tax is granted by the taxing agency and requires documentation to be submitted to OUC.

By Email: [email protected]

By U.S. Mail:

OUC – The Reliable One

Billing Operations, Tax Exemption Section

PO Box 3193

Orlando, FL 32802

For Questions:

Contact customer service, (407) 423-9018

Florida Department of Revenue Taxpayer Assistance | (850) 488-6800

TYPES OF TAX EXEMPTIONS

| Customer Type | Documentation Needed |

|---|---|

| Agricultural/Farm | Any Good Faith Form or DOR’s Suggested Exemption Certificate Electricity Used For the Production, Packing, or Processing of Agricultural Products on a Farm, or Used in a Packinghouse |

| Churches | Consumer Certificate of Exemption from DOR (DR-5 Form). Form must show exemption for “Religious- Physical Place” |

| Government (i.e. School Districts, State Colleges, Dr. Phillips Center, GOAA, City of Orlando, etc.) | Consumer Certificate of Exemption from DOR (DR-5 Form) |

| Hospitals | Consumer Certificate of Exemption from DOR (DR-5 Form) |

| Manufacturing | Any Good Faith Form or Manufacturer Suggested Tax Exemption Form |

| Medical Facilities | Any Good Faith Form or OUC’s Nursing Home, Assisted Living Facility, or Home Health Service Exemption Certificate |

| Non-Profit Organizations | Consumer Certificate of Exemption from DOR (DR-5 Form) |

| Residential Common Use (common areas used by residents within an apartment community, HOA) | Any Good Faith Form or OUC’s Residential Household Affidavit |